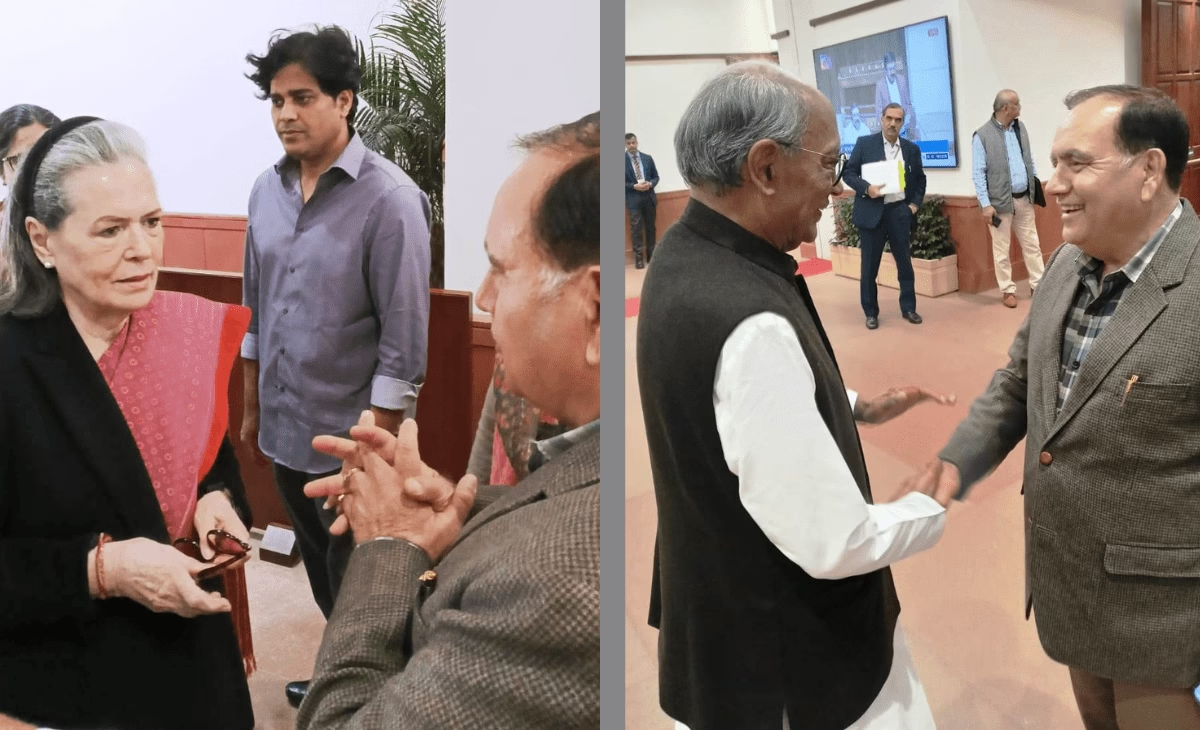

GST Council’s 56th Meeting Kicks Off

New delhi: The GST council convened for its 56th meeting, LED by Finance Minister Nirmala Sitharaman, to Discuss Significant Reforms Aimed at Modernizing The GST Framework. The proposed changes are designed to lower tax rates on essential goods, Eliminate Duty Inversion in Sector Like Textiles, and Simplife Compliance for Small and Medium Entrepries (MSMES).

During the two-day session, the council is expected to consider the GST Slabs to just two rates: 5% and 18%, which eliminating the existing 12% and 28% categories. Additionally, a special tax rate of 40% has been suggested for select items, Including tobacco and luxury Goods.

According to the comprehensive proposal from the center, which has been reviewed by a group of state finance ministers, approximately 99% of items currently taxed at 12% —t 12% —t Juices, and dry fruits – wind shift to a 5% tax rate.

Moreover, Electronic Appliances Like Air Conditioners, Televisions, Refrigerators, and Washing Machines, Ailong With Other Products Like Cement, Are Amon the 90% of Otemes That Wold Transisation from the 28% Slab Co. Reduced 18% Rate.

While States Governed by Opposition Parties Have Called for Compensation for Potential Revenue Losses Folling The GST Overhaul, Andhra Pradesh’s Finance Minister Payyavula Keshav Keshav Keshaw Export For The Center’s Proposals, Stating that they Benefit the Common Citizen.

Keshav Remarked, “As an alliance partner, we are backing the center’s gst rate rationalization proposal, which is advantageous for the public,” Prior to the Council Meeting. The Telugu Desam Party (TDP) from Andhra Pradesh is allied with the BJP-LED NDA government.

Prime Minister Narendra Modi Introduced The GST Reform Initiative during his independence day address on August 15. Subsequent, the central government shared a detailed plan with a Government Shared a Government Shared A Government Shared From Various States for Preliminary Assessment.

The center’s reform blueprint indicates that eight sectors – textiles, fertilizers, renewable energy, automotive, handicrafts, blockulture, health, and insufficiency – spiritual gains the Most from the Most from the Propode Rate Changes.

Before the Council Meeting on Wednsday, Eight Opposition-LED States-Himachal Pradesh, Jharkhand, Karnataka, Kerala, Punjab, Tamil Nadu, Tailangana, and West BENGAL-SHELLD ALED AHELD AILD AILD AILED AILED Demand for Revenue Protection Before Approving The Rate Changes.

Jharkhand’s Finance Minister Radha Kishore Warned That His State Cold Face a Revenue Loss of ₹ 2,000 Center If the Center’s GST reform plan is enacted.

“If the centers agrees to compensate us for any losses incurred, we will have no objections to approve the ageda before the council. I belly will not require Responsibility to compensate states for revenue losses in a federal structure, “Kishore stated after the option meeting.

Currently, the 18% GST Slab Accounts for a Significant Port of GST Revenue, Contributing 65%, While The 5% Slab Adds ONLY 7%. The Highest Tax Bracket of 28% on Luxury and Sin Goods Contributes 11%, and the 12% Slab Accounts for A Mere 5%.

The center’s gst reform proposal is billt on three Foundational Pillars: Structural Reforms, Rate Rationalization, and Enhancing the Ease of Living.

The structural reforms aim to provide stability and predictability, offering long-term class on rates and policy direction to foster Industry Confidence and Facilitete Business Planning.

Regarding the ‘Ease of Living’ Aspect, The Finance Ministry’s Proposal Includes A Seamless, Technology-Driven GST registration process, particular for Small Businesses and Startups. It also sugges implementing pre-filled GST Returns and Expediting Automated Refund Processing for Exporters and Thos Facing An Inverted Duty Structure.

“The Next Generation of GST Reforms will create a more open and transparent economy in the coming months, significly reducing Compliance Burdens and Enabling Small Businesses to Floudish,” Sitharan Stated During The foundation day celebrations of Tamil Nadu’s City Union Bank.